The 7th chapter of our accounting learning course is “Ledger”. In this article, we’ll learn the 30 most important accounting ledger questions and their answers.

It will help you understand the important ledger terms and their explanations quickly.

By reading this post, you may quickly prepare for accounting courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on.

So let’s get started…

Ledger Questions and Answers

The 30 important ledger questions and answers are as follows:

Question 01: What is Ledger?

Answer: The ledger is the book in which the summary of transactions from journals or day-books is posted on separate pages under separate headings to determine the number of assets, liabilities, incomes, expenses, and so on.

Question 02: What Are the Key Features of a Ledger?

Answer: The following are the key features of a ledger:

- Each account is given a title

- The Moving Balance Method and the T format are used to keep the ledger.

- Each account’s balance is identified individually.

- The journal serves as a reference book when preparing the ledger. At the time of recording to the Ledger, the journal folio number is mentioned.

- Ledger balances aid in verifying the arithmetic accuracy of accounting records.

- A trial balance is created using the balance of the ledgers.

Question 03: What is the Necessity and Importance of Ledger?

Answer: the necessity and importance of ledger are as follows:

- The ledger is the king of all accounting books.

- Since transactions are properly arranged in a sequence to accounts, users can easily access the information they need from the ledger.

- The ledger can provide information about a company’s total assets, liabilities, income, and expenses.

- For the purpose of preparing trial balances, ledger balances are used, and thus arithmetic accuracy is confirmed.

Question 04: Why is the Ledger known as the “King of all Books of Accounts”?

Answer: The following are the reasons why ledger is known as the “King of all Books of Accounts”:

- A summary of all transactions involving assets, liabilities, income, and expenses is recorded in the ledger accounts, and the position of the assets, liabilities, income and expenses is explained.

- Transactions cannot be recorded using the double-entry system if ledger accounts are not present.

- Without a ledger, the arithmetic accuracy of recording transactions cannot be verified.

- It accurately determines financial results and positions.

- The details of classified accounts must be known after they have been recorded in separate heads in Ledger accounts.

Question 05: What is the Difference between a Journal and a Ledger?

Answer: Journal and ledger both belong to the steps of the accounting cycle. A ledger by comparison is more important and useful than a journal.

The three important differences between journal and ledger are as follows:

- Keeping a journal is optional while compulsory for the case of a ledger.

- It is not possible to prepare financial statements directly from the journal, on the other hand, it is possible to prepare financial statements directly from the ledger.

- The journal is written on the basis of the documents while the ledger is written on the basis of the journal.

Question 06: What is Closing Balance?

Answer: The closing balance of an account is the debit or credit balance determined at the end of an accounting period. If the total of an account’s debit side exceeds the total of its credit side, the balance is referred to as the closing debit balance. Similarly, if the total of the credit side exceeds the total of the debit side, the balance is referred to as the closing credit balance.

Question 07: What is Opening Balance?

Answer: The opening balance is the closing balance of an account shown in the immediately preceding accounting period. The accounting period’s transactions must be recorded below the opening balances of all accounts.

Question 08: What is Debit Balance?

Answer: If the sum total of the debit side exceeds the sum total of the credit side of an account, the amount that is inserted in the amount column of the credit side above the line of that account and transferred to the debit side of the account below the line is known as the debit balance.

Question 09: What is a Credit Balance?

Answer: If the sum total of the credit side exceeds the sum total of the debit side of an account, the amount inserted in the amount column of the debit side above the line of that account to equalize the two sides and transferred to the credit side of the account below the line is referred to as the credit balance.

Question 10: What is Entry?

Answer: The act of recording transactions in a book of accounts is referred to as entry.

Question 11: What is Narration?

Answer: The narration is the detailed explanation provided below each entry in the journal.

Question 12: What is posting?

Answer: Posting is the process of transferring entries from the journal to the appropriate accounts in the ledger.

Question 13: What is casting?

Answer: Casting is the act of calculating the totals of both sides of each ledger account separately.

Question 14: What Is the Distinction Between Entry and Posting?

Answer: The two main distinctions between entry and posting are as follows:

The recording of transactions in books of accounts is referred to as entry. Posting is the process of recording transaction details from the journal to the ledger.

Entries can be classified into two types: journal entries and ledger entries. Posting is another term for ledger entry, which refers to the final stage of recording.

Question 15: What is Balancing of Accounts?

Answer: In general, the term balancing refers to what remains. The difference between the posted amounts in the debit and credit sides of the accounts is referred to as balancing of account.

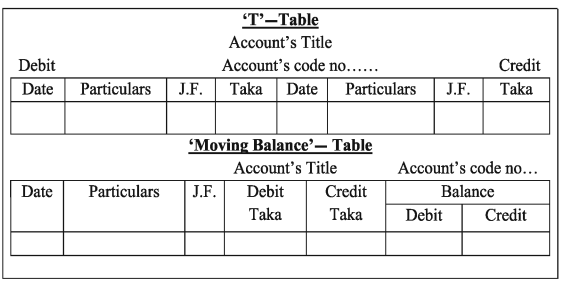

Question 16: What are The Two Tables for Preparing Ledger?

Answer: The two important tables for preparing ledger are as follows:

- “T” Table

- “Moving Balance” Table

Question 17: What are the Key Features of the “T” Table?

Answer: The Key features of the “T” table are as follows:

- The sum of the debit and credit sides must be equal. As a result, the greater amount must be recorded on both sides of the accounts.

- The accounts must be closed by drawing two parallel lines beneath the summation of each side.

- Generally, the difference between the debit and credit sides is determined at the end of a specific time period. The difference is then headed by balance CD, which is carried down and placed on the lower side, making both sides equal.

- At the end of a period, the balance C/D will be posted to the opposite side of the account mentioning Balance b/d, i.e. brought down at the start of the next period.

- The balance represents the greater sum indicated.

Question 18: What are the Key Features of the “Moving Balance” Table?

Answer: The key features of the “Moving Balance” table are as follows:

- There is no need for a specific date when using the moving balance method to calculate the balance. The balance is calculated immediately following each posting.

- In the moving balance method, the balance is displayed in separate columns.

- The total of debit and credit posting is unknown. This summary serves no purpose.

Question 19: What is C/D?

Answer: The full form of C/D is Carried Down. This term refers to writing an account’s balance at the end of an accounting period above the line to carry down for the next accounting period.

Question 20: What is B/D?

Answer: The full form of B/D is Brought Down. This term refers to the process of writing the balance at the end of an accounting period below the line on the same page of ledger accounts that will be used to record the transactions for the next accounting period.

Question 21: What is C/F?

Answer: The full form C/F is Carried Forward. This term refers to the balance or total of both sides of an account that have been transferred from the previous page of that account or another account.

Question 22: What is C/O?

Answer: The full form of C/D is Carried Over. This term is used to write the balance or total of both sides of an account that are to be transferred on the top of the next page of that account.

Question 23: What is B/O?

Answer: The full form of B/O is Balance Over. This term refers to the balances or totals of both sides of an account that have been transferred from the previous page of that account.

Question 24: What is the Classification of Ledger?

Answer: There are two types of ledger which are as follows:

- General Ledger

- Subsidiary ledger

Question 25: What is General Ledger?

Answer: The general ledger contains the statement of affairs and all accounts related to the income statement. Accounts receivable and payable are referred to as controlling accounts in it.

Question 26: What is Subsidiary Ledger?

Answer: Outside of the general ledger, a separate account is opened for each debtor and creditor. As a result, the individual amounts owed by the debtor and creditors can be easily determined. A subsidiary Ledger refers to the account that is created for each debtor and creditor.

Question 27: What are the Benefits of Ledger Sub-division?

Answer: The following are the primary benefits of ledger sub-division:

- Simple to gather information

- Simple to divide work

- Simple to handle

- Simple to complete

- Easy to minimize the possibility of error

- Simple to fix responsibility

- Simple to reconcile under a self-balancing system

Question 28: What are the Rules for Preparing Ledger Account?

Answer: The rules for preparing a ledger account are as follows:

Drawing the Form:

A bold vertical line or two sharp vertical lines divide each account leaf into two equal parts. The debit side is on the left, and the credit side is on the right. Following that, both sides are divided into four columns once more.

Posting:

When posting on the debit side of the ledger account, the journal’s credit account is to be written in a particular column and on the credit side of the ledger account the journal’s debit account is to be written in a particular column.

Folioing:

The folio column of the ledger contains the page number of the journal form on which those journal entries are transferred to the specific ledger account.

Casting:

The amount of debit and credit in each ledger account shows that the total of both sides is made equal by putting the difference in both sides. Casting refers to the total lining of debit and credit in this manner.

Account Balancing:

Account balancing is the act of equalizing the total of both sides by adding the debit balance on the credit side and the credit balance on the debit side.

Question 29: What is the Format of a Ledger?

Answer: The format of a ledger is as follows:

Question 30: How to Prepare a Ledger from The Following Transactions?

On 1 January 2022 Mr. David started a business with capital of $20,000. Transactions for the month were-

January 2: Goods purchased on cash $2,000

January 4: Goods sold on cash $3,000

January 7: A bank account opened by depositing $5,000

January 15: Goods purchased on credit $6,000

January 25: Paid salaries $4,000

January 31: Paid office rent $1,500

Answer: First, we prepare the journal entries for the following transactions:

General Journal of Mr. David

| Date | Accounts Title & Explanation | L.F. | Debit ($) | Credit ($) |

| 2022 Jan 1 | Cash A/c | 20,000 | ||

| Capital A/c | 20,000 | |||

| (Cash brought as capital) | ||||

| Jan 2 | Purchase A/c | 2,000 | 2,000 | |

| Cash | ||||

| (Goods purchased on cash) | ||||

| Jan 4 | Cash A/c | 3,000 | ||

| Sales A/c | 3,000 | |||

| (Goods sold on cash) | ||||

| Jan 7 | Bank A/c | 5,000 | ||

| Cash A/c | 5,000 | |||

| (Opened a bank account by depositing cash) | ||||

| Jan 15 | Purchase A/c | 6,000 | ||

| Creditors A/c | 6,000 | |||

| (Goods purchased on credit) | ||||

| Jan 25 | Salaries A/c | 4,000 | ||

| Cash A/c | 4,000 | |||

| (Paid office salaries) | ||||

| Jan 31 | Office rent A/c | 1,500 | ||

| Cash A/c | 1.,500 | |||

| (Paid office rent for the month of January) | ||||

| Total | 41,500 | 41,500 |

Now we prepare ledger accounts from gounral entries:

T Format

| Dr. | Cash A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| 2022 Jan 1 | Capital A/c | 20,000 | Jan 2 | Purchase A/c | 2,000 | ||

| Jan 4 | Sales A/c | 4,000 | Jan 7 | Bank A/c | 5,000 | ||

| Jan 25 | Salaries A/c | 4, 000 | |||||

| Jan 31 | Office Rent A/c | 1,500 | |||||

| Jan 31 | Balance C/D | 11,500 | |||||

| 24,000 | 24,000 | ||||||

| Feb 1 | Balance B/D | 11,500 |

| Dr. | Capital A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| Jan 31 | Balance C/D | 20,000 | 2022 Jan 1 | Cash A/c | 20,000 | ||

| 20,000 | 20,000 | ||||||

| Feb 1 | Balance B/D | 20,000 |

| Dr. | Purchase A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| 2022 Jan 2 | Cash A/c | 2,000 | Jan 31 | Balance C/D | 8,000 | ||

| Jan 15 | Creditors A/c | 6,000 | |||||

| 8,000 | 8,000 | ||||||

| Feb 1 | Balance B/D | 8,000 |

| Dr. | Sales A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| Jan 31 | Balance B/D | 4,000 | 2022 Jan 4 | Cash A/c | 4,000 | ||

| 4,000 | 4,000 | ||||||

| Feb 1 | Balance C/D | 4000 |

| Dr. | Bank A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| 2022 Jan 7 | Cash A/c | 5,000 | Jan 31 | Balance C/D | 5,000 | ||

| 5,000 | 5,000 | ||||||

| Feb 1 | Balance B/D | 5,000 |

| Dr. | Creditors A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| Jan 31 | Balance C/D | 6,000 | 2022 Jan 15 | Purchase A/c | 6,000 | ||

| 6,000 | 6,000 | ||||||

| Feb 1 | Balance B/D | 6,000 |

| Dr. | Salaries A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| 2022 Jan 25 | Cash A/c | 4,000 | Jan 31 | Balance C/D | 4,000 | ||

| 4,000 | 4,000 | ||||||

| Feb 1 | Balance B/D | 4,000 |

| Dr. | Office Rent A/c | Cr. |

| Date | Particulars | J.F. | Amount | Date | Particulars | J.F. | Amount |

| 2022 Jan 31 | Cash A/c | 1,500 | Jan 31 | Balance C/D | 1,500 | ||

| 1,500 | 1,500 | ||||||

| Feb 1 | Balance B/D | 1,500 |

I hope that by the end of this post, you have a good understanding of the “Ledger” chapter.

You will gain a better understanding of the “Ledger” chapter if you read these 30 important accounting ledger questions and answers on a regular basis.

You can read the previous six chapters of our accounting learning course here if you missed them.

- Introduction to Accounting Questions and Answers [With PDF]

- Accounting Transaction Questions and Answers [With PDF]

- Account Questions and Answers [With PDF]

- Double Entry System Questions and Answers [With PDF]

- Accounting Cycle Questions and Answers [With PDF]

- Accounting Journal Questions and Answers [With PDF]

- Cash BooK Questions and Answers [With PDF]

- Trial Balance Questions and Answers [With PDF]