30 Important Journal Questions and Answers [With PDF]

The 6th chapter of our accounting learning course is “Journal”. In this article, we’ll learn the 30 most important accounting journal questions and their answers.

It will help you understand the important journal terms and their explanations quickly.

By reading this post, you may quickly prepare for accounting courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on.

So let’s get started…

Journal Questions and Answers

The 30 important journal questions and answers are as follows:

Question 01: What is Journal?

Answer: The journal is a book of accounts in which business transactions are recorded with explanations in chronological order by determining debit and credit using the double-entry system.

Question 02: What are the Different Names of Journal?

Answer: The different names of journals are as follows:

- Primary Book

- Original Book

- Daily Book

- Subsidiary Book

Question 03: What are the Important Features of Journal?

Answer: The important features of the journal are as follows:

- It is a Primary book of accounts

- It is a daily book of accounts

- The transactions that take place are continuously recorded in the journal.

- After each transaction has taken place, it is analyzed using a double-entry system and recorded in a journal by debited to one party and credited to the other party.

- At the time of journalizing, each transaction is accounted for with an explanation that serves as a future reference.

- Transactions are recorded in a journal using a specific format.

- In the journal, the amount debited to one account by each transaction is credited to the other account by the same amount.

- When a transaction is recorded in a journal, it becomes a permanent document. If any transactional information is required, it is collected from the journal.

Question 04: What are the Objectives and Benefits of a Journal?

Answer: The journal’s objectives and benefits are as follows:

- It is a primary and fundamental book for keeping track of transactions.

- Transactions contain detailed descriptions of transactions.

- The necessary information can be easily obtained from various subsidiary journals.

- It improves accounting task efficiency.

- Aids in error reduction

- It aids in the distribution of accounting tasks among employees based on their efficiency.

- It is kept for future reference.

- It aids in the correction of errors.

- The ledger can be kept concisely and neatly.

Question 05: What is the Journal’s Role in the Recording Process?

Answer: The journal contributes significantly to the recording process in several ways:

- It reveals all of the consequences of a transaction in one place.

- It keeps a record of transactions in chronological order.

- It aids in the prevention or detection of errors because the debit and credit amounts for each entry can be easily compared.

Question 06: What is the Importance of Keeping a Journal?

Answer: The necessity of keeping a journal of various aspects is as follows:

- Transactions are easier to transfer to a ledger if they are recorded in a journal.

- Because transactions are recorded chronologically in a journal, the total number of transactions can be determined on a specific date, week, or month.

- It is also possible to determine the total number of transactions at various times.

- The journal can confirm the use of dual entities.

- If transactions are recorded in the journal before being recorded in the ledger, errors, and omissions from the ledger are less likely to occur.

- Transactions in a journal are organized systematically and chronologically. It can be used as proof or evidence in the future.

- Since the journal serves as a subsidiary book to the ledger, the preparation of the ledger becomes simpler, clearer, and error-free.

Question 07: Why Journal is called the Primary Book of Accounts?

Answer: Transactions are recorded in the journal as soon as they occur, so the journal is called the primary book of accounts.

Question 08: Why Journal is called the Subsidiary Book of Accounts?

Answer: Recording transactions in a journal makes it easier to transfer them to the ledger later, which is why the journal is referred to as a subsidiary book of accounts.

Question 09: What is the Classification of Journal?

Answer: There are two types of the journal which are as follows:

- Special Journal and

- Journal in Proper

Question 10: What are the Objectives and Importance of Classification of Journal?

Answer: The followings are the objectives and importance of classification of the journal:

- Benefits of work classification

- Time and labor savings

- Easy transfer to the ledger

- Make information accessible;

- Improve efficiency

- Gather information about preliminary results.

- Avoid mistakes and forgery.

Question 11: What is Special Book?

Answer: Special books are the divisions of the journals into various books that record transactions of a similar nature.

Question 12: What are the various kinds of Special Books?

Answer: The important subsidiary books generally used in modern business are as follows:

- Purchase Journal Book

- Sales Journal Book

- Return Inward Journal Book

- Return Outward Journal Book

- Cash Book

- Cash Receipt Journal Book

- Cash Payment Journal Book

Question 13: What is the Purchase Journal book?

Answer: A purchase journal book is a book that is used to record all credit purchases of goods.

Question 14: What is a Sales Journal book?

Answer: A sales journal book is a book that is used to record all credit sales of goods.

Question 15: What is Return Inward Journal Book?

Answer: A return inward journal book is a book that is used to record all of the returns of goods by the business’s customers.

Question 16: What is Return Outward Journal Book?

Answer: Return outward journal book refers to the book used to record all returns of goods by the business to the supplier.

Question 17: What is Cash Book?

Answer: The cash book is a book that is used to record all types of cash receipts and payments transactions.

Question 18: What is Cash Receipts Journal Book?

Answer: The cash receipts journal book is the book that is kept to record all types of cash received.

Question 19: What is Cash Payments Journal Book?

Answer: A cash payments journal book is a book that is kept to record all types of cash payments.

Question 20: What is the Journal Proper?

Answer: The journal proper is used to record all miscellaneous transactions that cannot be entered in any of the books of original entry due to their nature.

Question 21: What are the Various Kinds of Journal in Proper Book?

Answer: The important journal in the proper books are as follows:

- Adjusting Journal Book

- Rectification Journal Book

- Closing Journal Book

- Reversing Journal Book

- Opening Entries

Question 22: What is an Adjusting Journal Book?

Answer: The adjusting journal book is used to make all necessary adjustments for final account preparation.

Question 23: What is Rectification Journal Book?

Answer: The rectification journal book is the book in which all entries relating to error rectification are recorded.

Question 24: What is Closing Journal Book?

Answer: The closing journal book is used to close all nominal and fictitious accounts so that the balances can be transferred to the trading and profit and loss accounts.

Question 25: What are Opening Entries?

Answer: Opening entries are used to record assets and liabilities of various kinds that cannot be conveniently recorded in other books of original entry.

Question 26: What is a Simple Journal Entry?

Answer: Some transactions only involve two accounts, one debit, and one credit. This type of entry is referred to as a simple journal entry.

Question 27: What is a Compound Journal Entry?

Answer: Some transactions necessitate the use of more than two accounts when journalizing. A compound journal entry is one that requires three or more accounts.

Question 28: What is Journalizing? And what is the Procedure of Journalizing?

Answer: Journalizing is the process of entering transaction data into a journal.

The procedure of journalizing is as follows:

#1. Date: The year, month, and day of the transaction must be specified in this column. The journal must be kept continuously in accordance with the occurrence of the transaction chronologically as it occurs.

#2. Particulars: This column lists the debit and credit accounts and parties involved in the transactions. The debit party is always recorded first, followed by the credit party. In addition, a brief explanation is provided.

#3. L.F. (Ledger Folio): Debited and credited accounts associated with the transaction will be permanently recorded in the Ledger, the page number of which is indicated in this Column. As a result, the transaction can be easily identified from the ledger.

#4. Debit and Credit: The debit and credit amounts are posted in the debit and credit columns, respectively. In terms of amount, each column should be equal. If the journal is kept on separate pages, the total of both columns must be calculated and then written in the respective columns on the next page. After each journal entry, a line should be drawn in the description column.

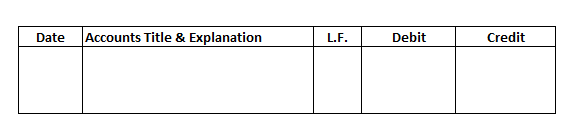

Question 29: What is The Format or Specimen of a Journal Book?

Answer: The format or specimen of a journal book is as follows:

Question 30: What will be the Journal Entries for the Following Transactions?

- Capital brought into the business by the owner

- Purchase of goods for sale

- Sale of goods

- Goods returned to creditors

- Drawings from business for personal purpose

- Purchase of Furniture

- Depreciation on assets

- Paid advertisement expenses

Answer: The journal entries for the following transactions are as follows:

| Date | Accounts Title & Explanation | L. F. | Debit | Credit |

| 1. | Cash A/c | *** | ||

| Capital A/c | *** | |||

| (Since the capital brought into the business by the owner) | ||||

| 2. | Purchase A/c | *** | ||

| Cash A/c | *** | |||

| (Since the goods purchased in cash for the purpose of sale) | ||||

| 3. | Cash A/c | *** | ||

| Sales A/c | *** | |||

| (Since the goods sold in cash) | ||||

| 4. | Accounts Payable A/c | *** | ||

| Purchase Return A/c | *** | |||

| (Since goods returned to creditors) | ||||

| 5. | Drawings A/c | *** | ||

| Cash A/c | *** | |||

| (Since drawings by the owner from the business for personal use) | ||||

| 6. | Furniture A/c | *** | ||

| Cash A/c | *** | |||

| (Since furniture purchased in cash) | ||||

| 7. | Depreciation Expense A/c | *** | ||

| Asset A/c | *** | |||

| (Since depreciation charged on asset) | ||||

| 8. | Advertisement Expense A/c | *** | ||

| Cash A/c | *** | |||

| (Since paid advertisement expense in cash) |

I hope that by the end of this post, you have a good understanding of the “Journal” chapter.

You will gain a better understanding of the “Journal” chapter if you read these 30 important accounting journal questions and answers on a regular basis.

You can read the previous five chapters of our accounting learning course here if you missed them.

- Introduction to Accounting Questions and Answers [With PDF]

- Accounting Transaction Questions and Answers [With PDF]

- Account Questions and Answers [With PDF]

- Double Entry System Questions and Answers [With PDF]

- Accounting Cycle Questions and Answers [With PDF]

- Accounting Ledger Questions and Answers [With PDF]

- Cash Book Questions and Answers [With PDF]

- Trial Balance Questions and Answers [With PDF]