30 Important Cash Book Questions and Answers [With PDF]

The 8th chapter of our accounting learning course is “Cash Book”. In this article, we’ll learn the 30 most important Cash Book questions and their answers.

It will help you understand the important Cash Book terms and their explanations quickly.

By reading this post, you may quickly prepare for accounting courses and for any competitive tests such as school and college exams, vivas, job interviews, and so on.

So let’s get started…

Cash Book Questions and Answers

The 30 important Cash Book questions and answers are as follows:

Question 01: What is Cash Book?

Answer: The cash book is a book that records both cash received and cash paid transactions. The primary book of accounts is the cash book, which is one of the major branches of the journal.

Question 02: What are the Features of Cash Book?

Answer: The important features of a cash book are as follows:

- A specific table/proforma is used to prepare the cash book. All receipts are recorded on the debit side, while payments are recorded on the credit side.

- Although the cash book is referred to as the primary book of accounts, it also serves as a permanent book.

- The cash book can be used to determine how much money was received and paid from various sources during a given period.

- The cash balance can be determined by calculating the difference between cash received and cash paid.

- The likelihood of cash theft, forgery, waste, and recording errors is significantly reduced.

- Complete control over the cash reserve is possible.

Question 03: What is the Importance of Cash Book?

Answer: The importance of a cash book is as follows:

- Proper recording of cash transactions ensured the smooth operation of the business and aided in making sound decisions.

- We can learn about the total amount of cash receipts and payments, the cash balance at a given time, and the total amount of cash purchase and sale.

- Is the amount of cash sufficient to purchase an asset in order to pay creditors and regular business expenses? If not, a cash book can be used to determine the most likely method of collection.

- By comparing the cash balance to the actual cash in hand, errors and anomalies can be identified and corrected.

- It is also possible to learn about bank transactions and bank balances by preparing a specific type of cash book.

Question 04: Why Cash Book is Both a Journal and a Ledger?

Answer: Cash Book is both a journal and a ledger. The reason behind this is as follows:

Similarities between a cash book and a journal:

- Primary book of accounts

- Brief narration description

- Chronological order to date

- Posting in the ledger account

- Special journal

Similarities between cash book and ledger accounts:

- Debit and credit side

- Similar ruling

- Balance recording in a trial balance

- Balance sheet items

- The final book of account

Question 05: What is the Classification of Cash Book?

Answer: There are four types of cash book which are as follows:

- Single Column Cash Book

- Double Column Cash Book

- Treble Column Cash Book

- Petty Cash Book

However, two types of cash books are now commonly used for an organization’s aggregate demand.

- Cash Receipt Journal and

- Cash payment Journal

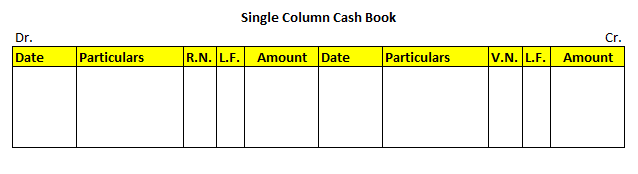

Question 06: What is Single Column Cash Book?

Answer: A single column cash book is one that has a single amount column on the debit side and a single amount column on the credit side to record cash transactions. Small businesses, on the whole, keep a single-column cash book.

Organizations that prefer cash transactions over bank transactions keep a single-column cash book.

Question 07: What is The Format of Single Column Cash Book?

Answer: The format of single column cash book is as follows:

Question 08: What is the Procedure of Writing a Cash Book?

Answer: The procedure of writing a cash book is as follows:

Date: This column contains the dates of cash transactions.

Particulars: The sources of cash received, as well as the names of such sources, are recorded on the debit side. Similarly, the heads of payments for which cash amounts are paid, as well as the names of payments, must be written on the credit side.

Receipt Numbers / Voucher Codes: Cash vouchers are the documentary evidence of cash transactions, such as cash memos, bills, and cash receipts, and they are serially numbered. When a cash transaction is recorded on the debit side of the ledger. The receipt number of the transaction’s related documents is to be recorded, and the voucher number of the transaction’s related documents is to be recorded in the V.N. column on the credit side.

Folio Ledger (L.F.) No: All cash transactions are entered into a cash book and then posted to ledger accounts. The page numbers of ledger accounts where transactions are posted must be recorded on both sides of the L.F. Columns.

Amount: The amounts of transactions must be written in these columns on both sides of the transaction.

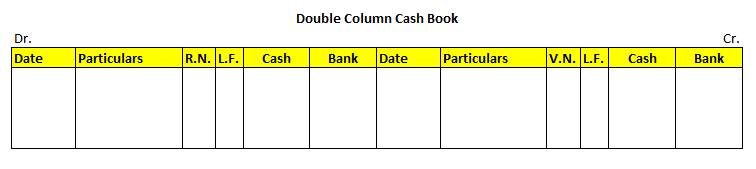

Question 09: What is a Double Column Cash Book?

Answer: A double column cash book is one that has two money columns—cash column and bank column—on both sides for recording cash and bank transactions.

Question 10: What are the Advantages of Double Column Cash Book?

Answer: The advantages of double column cash book are as follows:

- Aside from cash receipts and payments, a double column cash book can show the increase or decrease in cash in the bank as well as the bank balance.

- Organizations that handle both cash and bank transactions keep a double column cash book.

- When compared to a single-column cash book, a double-column cash book is more applicable and provides more information.

Question 11: What is the Format of Double Column Cash Book?

Answer: The format of double column cash book is as follows:

Question 12: What is Contra Entry?

Answer: Contra entry refers to transactions that affect both the cash and the bank account. Both cash and a bank represent an asset. As a result, if one account is debited for a fixed transaction, the other account must be credited. After posting both sides, the letter ‘C’ should be written on both sides in the Ledger folio column.

Question 13: What is Treble Column Cash Book?

Answer: The treble column cash book is one that has three money columns on both sides. Cash, bank, and discount are the columns.

A treble column cash book is prepared for cash and bank transactions, as well as mitigating debts and credits.

Question 14: What are the Advantages of Treble Column Cash Book?

Answer: The 3 important advantages of treble column cash book are as follows:

- Save the time and labor cost.

- Easily determine the cash and bank balances

- It is simple to determine the discount income and discount expense.

Question 15: What is Cash Discount?

Answer: The seller used to give the buyer such a discount in order to quickly collect the value of goods sold on credit. This is referred to as a cash discount.

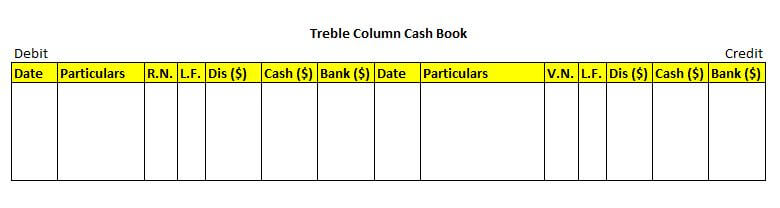

Question 16: What is The Format of Treble Column Cash Book?

Answer: The format of the treble column cash book is as follows:

Question 17: What is Cash Receipt Journal?

Answer: The cash receipts journal records the transactions that have an impact on the business’s financial receipts. The cash receipts journal format is designed so that all cash receipts are clearly visible.

Question 18: What is a Cash payment Journal?

Answer: When cash is paid through transactions, it is recorded in the cash payment journal.

Question 19: What is Cash Account?

Answer: The cash account is the account in which cash receipts and cash payments, i.e. cash transactions, are recorded chronologically in order to date without any narration from the general journal.

Question 20: What is Cash Balance?

Answer: Cash balance refers to the balance of a cash account on a specific date after comprising the totals of the debit and credit sides.

Question 21: What is Cash Voucher?

Answer: The cash voucher is the document used to prove the authority and authenticity of cash transactions when they are recorded in the cash book.

Question 22: What does the Credit Balance of the Bank Column Indicate?

Answer: The credit balance of the bank column indicate bank overdraft.

Question 23: What is Petty Cash Book?

Answer: The petty cash book is a cash book that records the number of petty cash receipts from the chief cashier as well as the details of petty cash payments made by the petty cashier.

Question 24: What are the Advantages of Petty cash Book?

Answer: The advantages of petty cash book are as follows:

- It saves the general cashier valuable time.

- It frees up space in the general cash book for petty incidental expenses.

- It provides a systematic check on the arithmetic accuracy of the records; and

- It reduces the possibility of petty cashier fraud and defalcation of cash.

Question 25: What are The Types of petty Cash books?

Answer: Petty cash book is of two types:

- Columnar Petty Cash Book

- Imprest Petty Cash Book

Question 26: What is Columnar Petty Cash Book?

Answer: Columnar petty cash book refers to the primary book in which the money received from the head cashier and the amount of expenditure for a specific period of an organization are recorded in chronological order of dates in separate money columns on both sides.

Question 27: What is Imprest Petty Cash Book?

Answer: Imprest petty cash book, like columnar petty cash book, has many money columns on the credit side and one money column on the debit side, as well as a specific column and a date column, which are also similar to those found in columnar or analytical petty cash books.

The head cashier provides a fixed amount of money to the petty cashier in advance for meeting expenditures of a specific period under this imprest system of petty cash book, and at the end of the period, the petty cashier submits to the head cashier a statement of expenditures incurred by him.

It should be noted that the amount spent by the petty cashier cannot exceed the amount received.

After proper verification of expenditures, the head cashier pays an amount equal to the amount spent by the petty cashier again in advance to equalize the petty cashier’s prefixed fund.

The keeping of a cash book under the stated system is known as the imprest petty cash book.

Question 28: What are The Benefits or Advantages of Imprest Petty Cash Book?

Answer: The benefits or advantages of imprest petty cash book is as follows:

- Minimization of time waste

- Labor-saving measures

- Maintaining control over petty expenses

- Checking the arithmetic accuracy of petty expenses

- Possibility for a petty cashier to work comfortably

- Fixed-imprest fund

- Misappropriation prevention

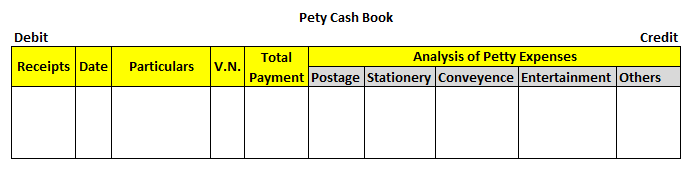

Question 29: What is the Format of Petty Cash Book?

Answer: The format of petty cash book is as follows:

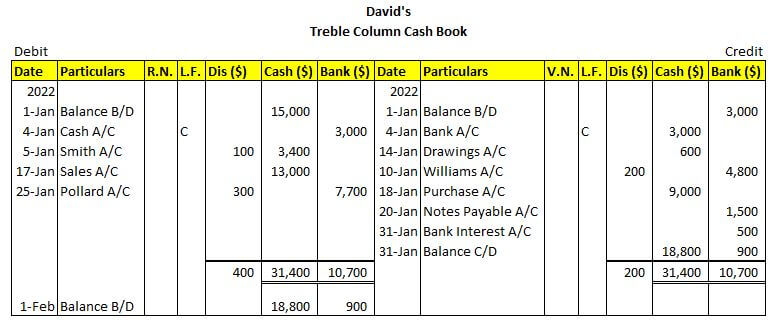

Question 30: How to Prepare a Treble Column Cash Book from Following Transactions?

During the month of January 2022 following transactions took place in David’s business.

2022

January 1: Cash in hand $15,000; Bank overdraft $3,000

January 4: Deposited in the Bank $3,000.

January 5: Received cash of $3,400 from Smith in full settlement of debt of $3,500.

January 10: A cheque paid Williams $4,800 and the discount received was $200.

January 14: Withdraw cash from the business for personal use $600.

January 17: Goods sold for cash $13,000.

January 18: Goods purchased for $10,000 at a discount of 10%.

January 20: Bank paid the notes payable $1,500.

January 25: Cheque received from Pollard $7,700 and discount allowed $300

January 31: Interest charged by the Bank $500

From the above information, prepare a Treble Column Cash Book.

Answer: The solution to the above-mentioned problem is as follows:

I hope that by the end of this post, you have a good understanding of the “Cash Book” chapter.

You will gain a better understanding of the “Cash Book” chapter if you read these 30 important cash book questions and answers on a regular basis.

You can read the previous four chapters of our accounting learning course here if you missed them.

- Introduction to Accounting Questions and Answers [With PDF]

- Accounting Transaction Questions and Answers [With PDF]

- Account Questions and Answers [With PDF]

- Double Entry System Questions and Answers [With PDF]

- Accounting Cycle Questions and Answers [With PDF]

- Journal Questions and Answers [With PDF]

- Ledger Questions and Answers [With PDF]

- Trial Balance Questions and Answers [With PDF]

- Accounting Principles Questions and Answers [With PDF]